The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

Solar energy credit arizona.

Not only do arizona residents get to take advantage of the federal tax credit but they can also receive the state s solar energy credit.

30 for property placed in service after december 31 2016 and before january 1 2020.

26 for property placed in service after december 31 2019 and before january 1 2021.

Arizona energy tax credit solar rebates grants incentives.

Arizona solar energy tax credit.

Favorable laws rebates property and sales tax exemptions and high electric prices make going solar in arizona a very wise economic decision.

Download 137 61 kb download 1 62 mb 01 01 2020.

Arizona residential solar and wind energy systems tax credit.

The credit amount allowed against the taxpayer s personal income tax is 25 of the cost of the system with a 1 000 maximum regardless of the number of energy devices installed.

The residential arizona solar tax credit reimburses you 25 percent of the cost of your solar panels up to 1 000 right off of your personal income tax in the year you install the system.

The renewable energy production tax credit is for a qualified energy generator that has at least 5 megawatts generating capacity and is not for a residential application.

Arizona s solar energy credit is equal to 25 of the costs of a solar system up to 1 000.

Energy equipment property tax exemption.

That is a significant amount of savings on your income taxes.

The residential renewable energy tax credit.

Arizona renewable and solar energy incentives.

There are three applicable percentages you can claim.

The most significant solar rebate offered in arizona is the credit for solar energy devices from the arizona department of revenue.

If the credit exceeds the taxes you owe you can continue to carry it over for up to five years.

This credit offers 25 off the gross cost of the system up to a maximum credit of 1 000.

Form year form instructions published.

Arizona state tax credit for solar.

Arizona home solar system owners are eligible for a credit worth 25 of their system cost or up to 1 000 whichever is less.

A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayer s residence located in arizona.

This incentive is an arizona personal tax credit.

Equipment and property tax exemptions.

Residential arizona solar tax credit.

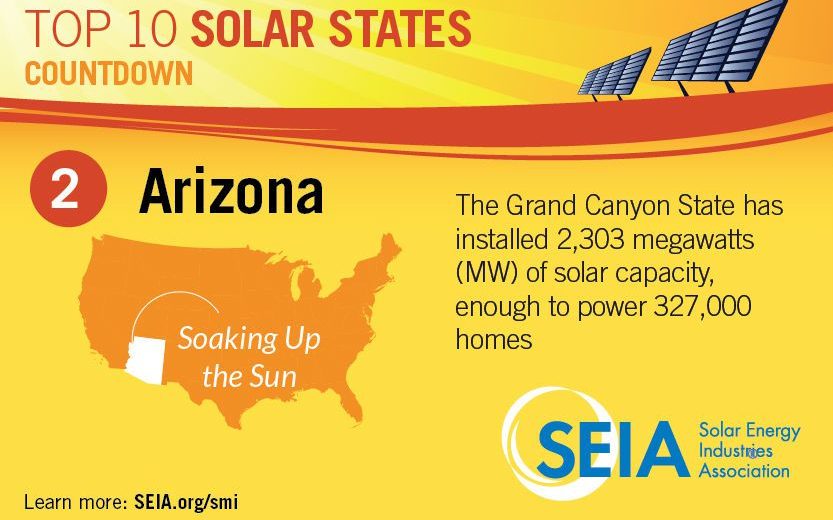

Arizona is a leading state in the national solar power and renewable energy initiative.

No preapproval is required for an individual income tax credit for a residential solar energy device tax credit that is claimed on form 310.